Wi2Wi Corporation Release of Audited Consolidated Results for Year Ending December 31, 2014

TORONTO, ON / ACCESSWIRE / May 6, 2015 / Wi2Wi Corporation ("Wi2Wi" or the "Company") is pleased to announce its audited consolidated financial results for the year ending December 31, 2014.

Wi2Wi is a vertically integrated manufacturer provide connectivity solutions, Precision Timing Devices, Frequency Control Products and Microwave Filters to the global market. Wi2Wi's miniaturized Wireless System-in-Package (SIP) connectivity Solutions are well accepted in the global market for Machine-to-Machine (M2M) and Internet of Things (IOT) and portable device embedded applications worldwide. Acquisition of net operating assets of Precision Devices Inc. ("PD"), in November 2014 enabled Wi2Wi to expand its product lines by adding Precision Timing Devices and Frequency Controllers to its existing product offering. Precision Device's, rugged, robust and reliable High end Crystals and Oscillators, Crystal Filters, RF and Microwave Filters are widely used and well recognised in the premium markets; Industrial, Avionics, Space, Medical and Defense.

Revenue

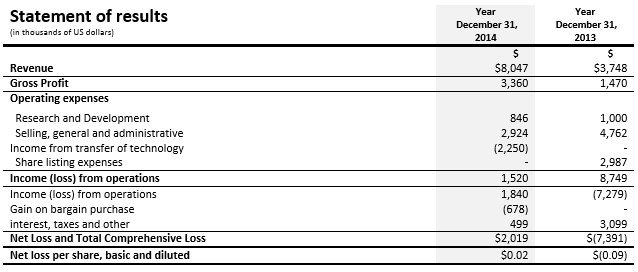

Revenues for the three months ended December 31, 2014 and 2013 were $3,348 and $310, respectively. Revenues from the acquisition of PD ("Middleton"), for two months ending December 31, 2014 was $1,590, while the Company's San Jose location ("San Jose") amounted to $1,758, compared to $310 in the fourth quarter of 2013. Revenue for the year ended December 31, 2014 and 2013 were $8,047 and $3,748, respectively. Revenues for San Jose increased by 72%. The Company had shippable backlog of approximately $3 million for the fourth quarter of 2014. With the addition of Middleton the Company continues to build its backlog currently in the region of $4.7 million.

Gross Profit

Cost of revenues consists of the costs of parts; costs incurred with contract manufacturers to assemble and test the Company's products, as well as the direct and indirect costs incurred to control and test the in-house and outsourced manufacturing and supply chain.

Gross profit for the fourth quarter ended December 31, 2014 and 2013 were $965 (gross margin 29%) and $109 (gross margin-35%), respectively. The reduction in gross margin is primarily due to Middleton location, where the products are manufactured in-house, and very labour intensive. The gross margin at the San Jose location continue to improve 52.5%, compared to 35% in same quarter in 2013, an increase in gross profit of 48.5%. Company's control over costs continue to improve the gross margin yield, and we are working hard to implement controls over the Middleton, in order to bring the margins to more acceptable levels. The process will take some time to implement and initial results are very favorable.

Gross profit for the year ended December 31, 2014 and December 31, 2013 were $3,360 and $1,470 respectively. Gross profits increased by 127% for the year ended December 31, 2014, compared to the same period in 2013. The increase in revenue year over year was a significant reason for the improvement, plus the effect of the focus to improve the gross margin on sales to customers.

Precision Devices Inc. ("PD") description

In 2014, Wi2Wi acquired the manufacturing plant, inventory, and net current assets related to operations of Precision Devices, a company based in Middleton, Wisconsin. Precision Devices, is a global supplier of timing devices and frequency control devices. Their core business consist of extremely high-end, standard and highly customizable, crystals, crystal filters and oscillators for complex Radio, RF/Microwave, GPS, Instrumentation for the applications in the Avionics, space, Medical, Infrastructure and Defense markets. PD also manufactures low-cost, commercial grade crystals and oscillators for competitive consumer applications. In addition to the manufacturing capability, PD also has fully functional high end reliability test lab, production testing and back end operations in house. The acquisition is very strategic for the Company in that we have now access to certain markets such as avionics, space and defense which would have taken the Company significant amount of time and money to develop. The acquisition also brings tier one customers where the company did not have access prior to the acquisition. The acquisition of the manufacturing facility, which also includes the administrative offices, and sales force allows the Company to significantly streamline its operations and reduce the overhead structure.

"We have had a very eventful year, where we have seen the Wi2Wi increase its sales, restructured the operations to reduce overheads and the acquisition of the net operating assets and the product lines of Precision Devices will help grow the company in the coming years," said Mr. Zachariah Mathews, President CEO and Interim Chairman of the Company

For further information, please contact:

Zachariah Mathews

President and Chief Executive Officer

408-416-4202

This email address is being protected from spambots. You need JavaScript enabled to view it.