TORONTO, ON / Wi2Wi Corporation (“Wi2Wi” or the “Company“) (TSX Venture: YTY) a leading global developer and manufacturer of wireless connectivity solutions, high precision frequency control devices, timing devices, and microwave filter devices announces its unaudited condensed consolidated interim financial results for the three and six month periods ending June 30, 2015, and that it has received conditional approval from the TSX Venture Exchange (TSXV) for the shares for debt exchange previously announced on June 19, 2015.

On July 31, 2015, the Company signed a Debt Settlement and Investor Rights Agreement reflecting the previously announced terms of the shares for debt conversion. This transaction received conditional approval from the TSXV, on August 20, 2015 and the Company will seek shareholders of approval at a Special General Meeting to be held on September, 25, 2015 as it is expected that LaSalle Capital Group II-A L.P (LaSalle), will be a “control person” as defined under TSXV policies following completion of the transaction.

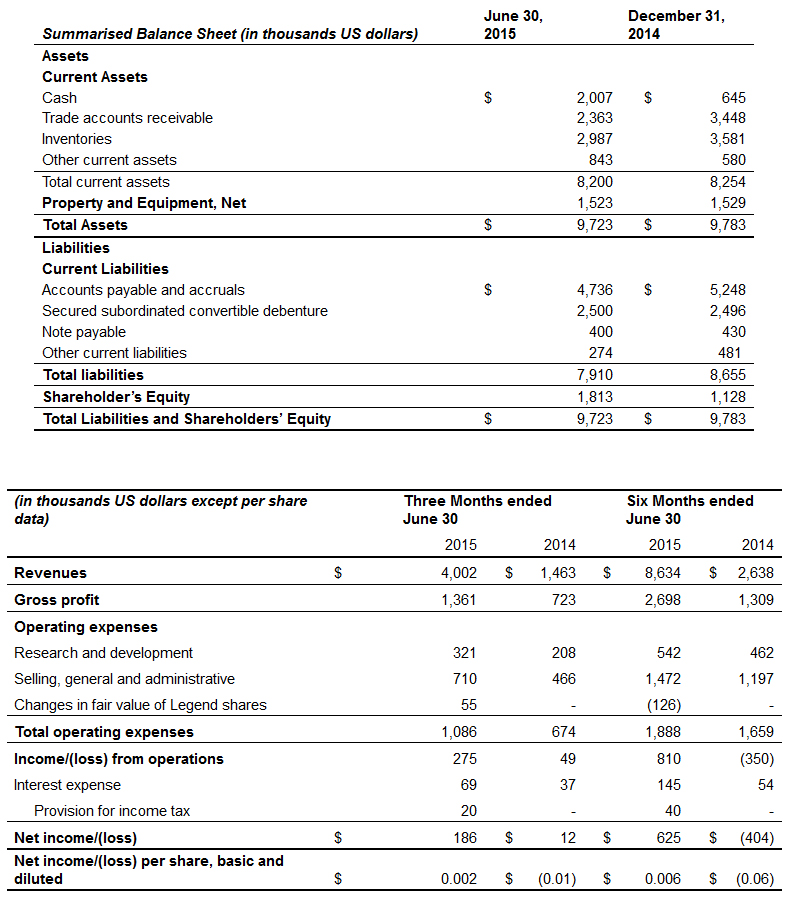

“We are extremely pleased with the transactions that eliminates a major amount of the Company’s debt,” said Zach Mathews, President and Chief Executive Officer of the Company. “It shows a vote of confidence in the Company by LaSalle, a leading U.S. institutional investor, who will be part of our shareholder group and enable the Company to be on a much better financial position and to focus on growing the business and increasing shareholder value. We anticipate that the shareholders will vote for this transaction at the upcoming Special General Meeting on September 25, 2015. At the conclusion of this transaction our debt to equity ratio will improve from 4.36 to 0.83 and our current ratio improves from 1.03 to 1.96”.

Highlights (all monetary amounts are in thousands of US dollars)

- Entered into a shares for debt transaction with LaSalle to issue shares as consideration for an aggregate amount of $3,192, which includes principal amount of the secured subordinated convertible debenture, accrued interest and interim funding provided by LaSalle.

- Revenues for the three month period ended June 30, 2015 and 2014 were $4,002 and $1,463 respectively. Revenue for the six month ended June 30, 2015 and 2014 were $8,634 and $2,638, respectively. Significant increase in revenues was due to combination of increased sales of wireless connectivity solutions, and through its acquisition, frequency controllers and timing devices, and contribution from the new microwave business unit.

- Gross profits for the three month periods ended June 30, 2015 and June 30, 2014 were $1,361 and $723, respectively. Gross profits increased by 88% for the three month period ended June 30, 2015, compared to the same period in 2014. Gross margins for the three month periods ended June 30, 2015 and 2014 were 34% and 49.4%, respectively. Gross profits for the six month period ended June 30, 2015 and 2014 were $2,698 (gross margin 31.2%) and $1,309 (gross margin-49.6%), respectively. The increase in gross margin dollars is due to contribution of the acquisition. However the gross margin as % of revenue has decreased, because the precision devices historically yielded a lower margin. The Company is in process of improving manufacturing yield, increasing efficiency, and optimizing manufacturing batch sizes. Successful efforts in manufacturing cost reductions and reviewing the pricing of certain products should help increase the margins in the future. This process will take some time to implement and initial results are very favorable.

- Research and development expenses for the three month period ended June 30, 2015 and 2014 were $321 and 208 respectively. For the six month periods ended June 30, 2015 and 2014 the research and development costs were $542 and $462 respectively, an increase of 17%. The Company is looking to develop new products in timing devices, frequency controllers, RF and microwave filters, and wireless connectivity solutions.

- SG&A expenses for the three month periods ended June 30, 2015 and 2014 were $710 and $466, respectively. For the six month periods ended June 30, 2015 and 2014 the SG&A costs were $1,472 and $1,197 respectively. The increase for the period ended June 30, 2015 as compared to same period in 2014 is due principally to the acquisition, mitigated by reduction of sales staff in San Jose.

- Liquidity and Capital Resources: As of June 30, 2015, the Company had cash of $2,007 compared to $131 as of June 30, 2014, and $645 as at December 31, 2014. The Company had a net working capital of $290 as of June 30, 2015 compared to working capital deficit of $401, as of December 31, 2014 respectively and shareholders of equity of $1,813 and $1,128 at June 30, 2015 and December 31, 2014 respectively. In period ending June 30, 2014 the Company had a working capital deficit of $2,949. The Company has started to generate positive cash flow from operations. At the conclusion of the LaSalle transaction liabilities will be reduced, working capital increased and shareholders of equity substantially increased.

For further information, please contact:

Zachariah Mathews

President and Chief Executive Officer

408-416-4202

zach@wi2wi.com